For full coverage of Middle East business, see MEED

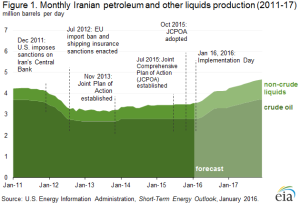

The US’ Energy Information Administration (EIA) said in a report issued on 22 January that Iran’s crude oil production is expected to reach 3.3m b/d at the end of 2016 and 3.7m b/d at the end of 2017.

This compares with just under 2.9m b/d at the end of 2015. The forecast increase is less than some are forecasting. Iran says it aims to increase output by 1.5m b/d in 2016.

“EIA estimates an uncertainty range of +/- 250,000 b/d surrounding these year-end projections, with actual outcomes dependent on Iran’s ability to mitigate production decline rates, deal with technical challenges, and bring new oil fields into production,” the report said.

The EIA said most of Iran’s forecast production growth will come from its pre-existing crude oil production capacity that is currently shut in, while the remainder will come from newly developed fields. Iran has a number of new oil fields that Iranian and Chinese companies have been developing over the past several years, which have the potential to add 100,000 b/d to 200,000 b/d of crude oil production capacity by 2017.

The EIA said Iran’s condensate and natural gas plant liquids (NGPL) production is currently almost 750,000 b/d, of which 75% is condensate and the remainder NGPL. Iran’s non-crude liquids production has grown over the past few years. The main buyers of Iran’s non-crude liquids have been in countries in Asia, mainly China, and the United Arab Emirates (UAE).

“Iran’s non-crude liquids production is expected to grow by 150,000 b/d by the end of 2016 and by an additional 100,000 b/d by the end of 2017, as more project phases at the South Pars natural gas field come online,” the report said. “More than 80 per cent of Iran’s condensate production comes from the South Pars field located offshore in the Persian Gulf, which is Iran’s largest nonassociated gas field. Lack of foreign investment and insufficient financing, stemming from international sanctions, have slowed the development of South Pars. However, some progress has been made in recent years, and sanctions relief is expected to quicken the pace of development of its remaining phases over the next decade.”

The report said Iran’s petroleum and other liquid fuels consumption expected to remain flat over the next two years and that crude oil and other liquid fuels from the production increase is likely to be sold in export markets.

“The pace at which Iran will ramp up its exports now that sanctions are lifted is uncertain. Iran has a considerable amount of oil stored offshore in tankers (between 30 million and 50 million barrels), most of which is condensate, and crude oil stored at onshore facilities,” the report said. “Initial post-sanction increases in Iranian exports will most likely come from storage, while meaningful production increases will occur after some of the storage is cleared.”

The report said Iran is targeting its traditional customers in an attempt to reestablish trade links and regain market share. The anticipated global inventory builds in 2016 will present challenges to Iran in regaining market share quickly. Iran lost a significant amount of its market share in Asia, Europe, Turkey, and South Africa after the last round of sanctions hit, causing a more than 1.0 million b/d drop in Iran’s crude oil and condensate exports after 2011. Iran lost an average of 3 per cent of its market share in Asia, which was mostly purchasing Iranian heavy crude oil. Iran lost 5 per cent of its market share in Europe, which mostly purchased Iranian light crude oil. Iran lost 22 per cent and 20 per cent of its market share in Turkey and South Africa, respectively, where Iran previously was the top oil supplier.

Displaced Iranian oil was substituted by multiple countries, including Nigeria, Iraq, Russia, Angola, UAE, Kuwait, and Saudi Arabia. Nigerian barrels were the top substitute in Europe and South Africa, Russian barrels in Asia, and Iraqi barrels in Turkey.