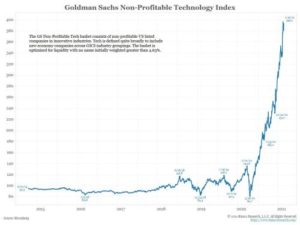

The Goldman Sachs non-profitable technology index in the middle of January was four times its level at the start of the Covid crisis.

The Goldman Sachs non-profitable technology index in the middle of January was four times its level at the start of the Covid crisis.

This is being dismissed as a curious manifestation of unprecedented times. But there are profound implications that could bring about unexpected social and economic change.

Investors blessed Jo Biden as the 46th US president by sending the Dow Jones Industrial index to an all-time high on the day of his inauguration on 20 January. But share markets almost everywhere are also close to record levels. The FT 100 index that tracks the most valuable firms on the London Stock Exchange (LSE) has risen by a third since Covid fears crashed equity prices last March.

The US’ GDP was down in 2020 both in real and current terms. Its budget deficit last year was 15 per cent of GDP. America’s unemployment rate now is almost twice the level this time last year. These are figures associated with a disastrous economic slump that should have investors spooked not begging for more.

Interest rates are around zero but there’s no prospect President Biden will send them up. He’s announced a $1.9trn public spending increase and $2trn of investment in infrastructure.

Investors worried about the apparently unsustainable level of equity prices are being told to buy yet more shares. Low interest rates have lifted real estate. The only caveat is avoid bonds where inflation-adjusted returns are negative. Almost nothing is risky any more.

These are magnificent times for the wealthy and pretty good ones for people with debt. Rates of interest are below inflation. The value of loans will inexorably shrink in real terms.

Desperate to justify their existence, fund and money managers are hunting for assets where prospective returns might be better than average. One result is the enormous valuations attached to quoted companies with a technology angle that don’t make money.

Don’t look now but it seems we’ve arrived a point at where capitalism can survive without operational profits. This has never happened before and could be a passing phenomenon.

But we may need to digest the possibility that for the first time in history, humans face no financial risk. That means that you can buy most assets and confidently expect them to grow in value in real terms. Sounds like heaven.

But if there is no risk, what is the justification for profit? Ethically, it’s been defended as a reward for bravery but that argument now falls. In economics, the case for profit was based on the idea its existence was necessary for the efficient functioning of the system. That too seems to have tumbled.

Rich people have conventionally said their wealth is due to hard-work and risk-taking. Now it looks like those who have are getting even more with no effort.

If this pattern persists, wealth will lose its status. If getting it involves no effort or courage then being rich signifies nothing, not even luck. Someone with an apartment in Monte Carlo and a yacht moored at Nantucket will look like he or she is simply complicating their lives and wasting time on things with no meaning.

It has been said that capitalism would eventually destroy itself. Following the collapse of Communism in Europe, this forecast was ridiculed as out of date and profoundly wrong.

But the Masters of the Universe that command the global economy in the 21st century are engineering the very thing the system’s greatest enemies failed to deliver.